Building Wealth Through Investing

Building wealth through investing is a vital part of any financial plan but can often be one of the most confusing and emotionally challenging experiences you will encounter. Many marketers promise “get rich quick” stock suggestions or sure- fire “market timing” schemes. It is easy to prey on most people’s desire to acquire wealth quickly without applying the diligence, prudence and sacrifice that is actually necessary.

Six Principles to Investment Success

We can often look into the rearview mirror and feel as though we “should have done” this or that. This “noise” can often cause us to make mistakes as we try to catch the next trend, or cause us not to take action at all. In most cases, following this noise usually leads to losing money. The old adage, “If it sounds too good to be true…” also holds true for investing.

To build wealth successfully over the long term, it is important to understand first what your accumulation goals are, the time you have to accomplish them, and to follow the six basic principles to investment success:

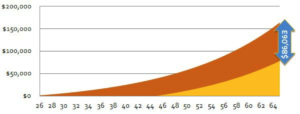

- Start today

The biggest threat to your investment program is not the return but procrastination. Start building the habit of “paying yourself first”. Begin at a comfortable amount and add to this over time.

- Start at age 25, $1,000 per year with 6% compounded interest until age 65

- Start at age 45, $2,000 per year with 6% compounded interest until age 65

- Use tax shelters

Take advantage of Government Programs to receive tax deductions, tax sheltered growth, and grants. The four most basic ones available are:

►►RRSP (Registered Retirement Savings Program)

►►TFSA (Tax Free Savings Account)

►►RESP (Registered Education Savings Program)

►►Cash Value component of permanent life insurance policies

- Understand risk

Is risk good or bad?

We tend to think of risk in predominantly negative terms, as something to be avoided or a threat that we hope won’t materialize. In the investment world, however, risk is inseparable from performance, and rather than being desirable or undesirable, it is simply necessary.

Understanding risk is one of the most important parts of financial education. Generally, investments with a low risk also generate a low return. Investing in a bank deposit will probably earn a return of around 1-2% per annum. Investing in shares, however, could generate much higher returns; but there’s also a much higher risk that the investment will drop in value.

We all have different attitudes towards investment risk. Consider how comfortable you are with the possibility of losing money or with the returns on your investments fluctuating widely from year to year. This is a personal evaluation only you can make.

What risk level is right for me?

The length of time you are prepared to invest the money for is an important part of understanding your risk profile. High-risk strategies can offer higher returns and should usually be engaged over a long time period. A low-risk option tends to suit investors who have a short investment time frame or are uncomfortable with the volatility of high-growth assets.

Everyone feels differently about investment risk. If you take out high risk investments only to be consumed by anxiety, you are at the wrong level of risk. You need investments that balance your appetite for risk with the ability to reach your financial goals. Find out where your risk level is so that you can make investment decisions that won’t stop you from sleeping at night.

- Diversify

A way of managing risk

Diversification is a risk management technique that combines a wide variety of investments within a portfolio. The rationale behind this technique is that a portfolio of different kinds of investments will, on average, yield higher returns and pose a lower risk than any individual investment found within the portfolio. Diversification strives to smooth out unsystematic risk events in a portfolio so that the positive performance of some investments will neutralize the negative performance of others. Simply put, it avoids having “all your eggs in one basket”.

- Match your investment portfolio to your risk profile

Find your most suitable investment plan through asset allocation

Asset allocation is an investment strategy that aims to balance risk and reward by apportioning a portfolio’s assets according to an individual’s goals, risk tolerance and investment horizon. The three main asset classes – equities, fixed-income, and cash and equivalents – have different levels of risk and return, so each will behave differently over time. There is no simple formula that can find the right asset allocation for every individual, so it is important to go through a process to define the appropriate asset allocation to meet your financial goals.

- Rebalance

Maintain your portfolio’s optimal performance over time

As your portfolio grows, certain areas can become heavier in weighting; therefore it is beneficial to periodically re-spread the proportions to ensure that balance is achieved. Shifting money away from an asset category when it is doing well in favor of an asset category that has underperformed may not be easy, but if done systematically, results in employing a “buy low, sell high” strategy.

Following these six simple principles will ensure that you are in the fast lane on the road to building wealth.

Four Ways to Minimize Tax

- Registered Retirement Savings Plan (RRSP)

Save now, tax-free • Pay taxes later at a lower tax bracket

An RRSP is the most effective retirement savings and investing tool available to most Canadians. It lets the money you invest grow unaffected by taxes until it is withdrawn. That means your money has the potential to grow faster and accumulate more returns. What’s more, you’ll get a tax deduction for every dollar you put into an RRSP, reducing your annual tax bill. Here’s how it works:

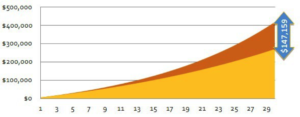

Tax Sheltered Investment Growth

Investments in an RRSP grow on a tax-deferred basis until money is withdrawn. The fact that your plan is “registered” with the Canada Revenue Agency allows you to benefit from this tax-deferred growth. Outside an RRSP, most investments are taxed. Interest earned is fully taxable, half of capital gains are taxable and dividends are taxable but eligible for the dividend tax credit. Inside an RRSP, none of these taxes apply. Because you pay no tax on investment growth while your money remains inside an RRSP, your investments compound far more quickly. At the end of the road, that makes a huge difference. Even though you’ll be taxed on amounts you withdraw from RRSP savings during retirement, your tax rate will likely be lower than during your working years. So the tax bite will be considerably smaller. And the money left in the retirement plan continues to grow sheltered from tax.

Registered vs. Non-Registered Investing

- Registered funds, $5,000 per year, 6% compounded interest for 30 years

- Non-Reg. Funds, $5,000 per year, 6% compounded interest, 40% MTR, for 30 years

- Registered Education Savings Plan (RESP)

Tax savings that benefit the whole family

RESPs permit savings to grow tax-free until the beneficiary is ready to go to college, university or any other eligible post-secondary educational institution. Under the family RESP plan, if your child decides not to attend higher education, the RESP can be transferred to another beneficiary such as a sibling. RESP assets can also be transferred into parental RRSPs, provided the parent has enough contribution room left.

Take advantage of additional savings

Each child beneficiary can collect up to $500 per year from the Canada Education Savings Grant (CESG) program, to a maximum of $7,200 over the life of the RESP. That’s an automatic 20% return on your investment! The simplest way to achieve this is to set up a convenient pre-authorized contribution of about $208 a month. And the earlier you start, the more you take advantage of accumulated growth.

- Tax Free Savings Account (TFSA)

Tax Free Savings Accounts (TFSA) were introduced in the 2008 Federal Budget effective January 1, 2009 to help us save and invest for our future. Canadians who are 18 years of age or older may contribute up to $5,500 per year to a TFSA. TFSAs are great because the earnings are tax-free. In Canada, only your principal residence and your TFSA are true tax free investments.

Here are the highlights:

►►Your TFSA contribution can go to a wide array of savings or investments, such as a savings account, GICs, Mutual Funds, etc.

►►The unused contribution room can be carried forward, so if you can’t make the full $5,500 contribution one year, you can catch up in a subsequent year.

►►Withdrawals are tax free and the earnings are too.

►►Unlike RRSPs, if you make a withdrawal from your TFSA one year, it creates new room. You can therefore put the amount withdrawn back into the plan in a subsequent year.

- Permanent Cash Value Life Insurance

A multifaceted tool to serve your insurance, investment and tax sheltering needs

Whereas temporary life insurance covers a variety of short term risks, such as providing mortgage protection or income replacement, permanent life insurance not only covers risks but also acts as an important vehicle to maximize estate and retirement planning as well as business succession planning.

Beyond the pure insurance aspect, most policies provide the owner with the option of contributing more money into the policy than is necessary to pay for the cost of insurance (COI). This additional money is invested and grows tax sheltered, similar to an RRSP. The policy holder is limited by certain government guidelines for how much extra money they can contribute, but this amount can be substantial.

Tax sheltered growth • Tax free death benefit • Flexibility for withdrawals

Although the extra funds contributed are not tax deductible, they do grow tax sheltered, and, if not withdrawn, will pay out tax free to the insured’s estate. It is one of the few outright, tax free, intergenerational transfers allowed by the CRA. In addition to the tax free death benefit, the policy owner can access the funds for other purposes prior to death, for example, to pay off a mortgage or supplement retirement income.

The benefits of tax sheltering and eventual tax free payout of the invested funds becomes even more valuable in Corporate Planning, where other tax advantaged plans such as RRSP’s and TFSA’s are not available, graded tax categories do not apply, and all passive investment assets are taxed slightly above the higher marginal personal tax rate.

Tax efficient strategies are available for every individual’s needs. Contact a qualified financial advisor today to explore the options that are right for you.

Take the first step today to better achieve your financial goals.